31.4K

Downloads

448

Episodes

The FICPA podcast is to inform and educate our members & the CPA community with today’s hottest issues. Our mission is to serve our members, enhance their competency & professionalism, support professional standards, promote the value of our members & advocate on behalf of the CPA Profession.

Episodes

Monday Nov 27, 2017

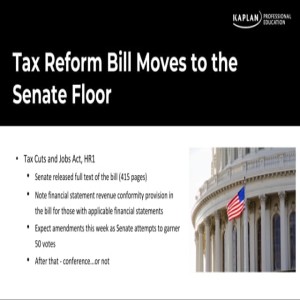

Federal Tax Update - Nov. 27, 2017

Monday Nov 27, 2017

Monday Nov 27, 2017

https://player.vimeo.com/video/244456961

This Week's Topics

- HR1 moves to the Senate floor this week

- Taxpayer does not have COD income when relieved of requirement to pay back overpayments on pension

- Qualified plan relief provisions extended to victims of California wildfires

- Court does not accept attempt to use FLP discount to create income tax loss from liquidation of S corporation formed to hold FLP interest

- No basis to shareholders in debt to S corporation other S corporation shareholders controlled

- IRS issues FAQ on QSEHRAs

Monday Nov 20, 2017

Federal Tax Update - Nov. 20, 2017

Monday Nov 20, 2017

Monday Nov 20, 2017

Monday Nov 13, 2017

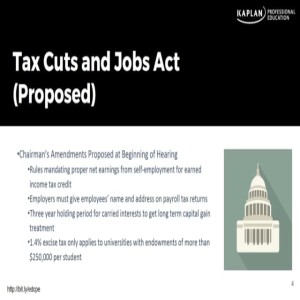

Federal Tax Update - Nov. 13, 2017

Monday Nov 13, 2017

Monday Nov 13, 2017

https://player.vimeo.com/video/242386558

This Week's Topics

Monday Nov 06, 2017

Federal Tax Update - Nov. 6, 2017

Monday Nov 06, 2017

Monday Nov 06, 2017

Monday Oct 30, 2017

Federal Tax Update - Oct. 30, 2017

Monday Oct 30, 2017

Monday Oct 30, 2017

https://player.vimeo.com/video/240300175

This Week's Topics

- House adopts Senate budget resolution beginning tax reform process

- A taxpayer’s amount of claimed theft loss found excessive by Tax Court

- An expert’s testimony did not substitute for records of cost of goods sold

- IRS summons to state agency found to be proper

- IRS memo discusses indirect loan issues for church 403(b) plan

Monday Oct 23, 2017

Federal Tax Update - Oct. 23, 2017

Monday Oct 23, 2017

Monday Oct 23, 2017

https://player.vimeo.com/video/239257011

This Week's Topics

- IRS releases inflation adjusted tax factors for 2018

- LB&I Division issues guidance on unit of property and major component issues for the mining industry

- IRS announced retirement plan numbers for 2018

- IRS announces nonacquiesence in S corporation/real estate professional decision

- Anti-Kerr regulations officially withdrawn by the IRS

- 2017 Returns without health care information will not be accepted for efiling

- A court decision that appears to arrive at approximately the right place, but for all the wrong reasons

Monday Oct 16, 2017

Federal Tax Update - Oct. 16, 2017

Monday Oct 16, 2017

Monday Oct 16, 2017

https://player.vimeo.com/video/238200331

This Week's Topics

- Filing date relief issued by IRS for victims of Northern California wildfires

- Challenge to minister’s housing allowance exclusion returns to court

- Tax Court will assert strict subordination requirement for mortgages on conservation easements outside First Circuit

- Signature no longer required for §754 election

- Retroactive loss of tax-exempt status going back a decade proves very costly in terms of interest on unpaid tax

- IRS email discusses potential impact on due date disaster relief and date for assessment of tax

Monday Oct 09, 2017

Federal Tax Update - Oct. 9, 2017

Monday Oct 09, 2017

Monday Oct 09, 2017

https://player.vimeo.com/video/237220639

This Week's Topics

- South Dakota petitions the Supreme Court for its Quill challenge

- Congress passes a Hurricane relief bill

- Taxpayer did not willfully fail to file FBAR

- Parents are held liable to repay dependent son’s advanced health insurance credit

- LB&I announces method that can be used to start with ASC 750 research expenses in computing qualified research expenditures

- Time off donation programs expanded to cover Hurricane Maria relief donations

- IRS releases special per diem rates for new fiscal year

Monday Oct 02, 2017

Federal Tax Update - Oct. 2, 2017

Monday Oct 02, 2017

Monday Oct 02, 2017

https://player.vimeo.com/video/236220903

This Week's Topics

- Standard deduction and personal exemptions

- Individual tax brackets

- Alternative minimum tax repeal

- Itemized deductions

- Work, education and retirement issues

- Estate and GST Tax repeal

- Business tax rates

- Expensing of capital improvements

- Interest expense

- Other business deductions and credits

- Offshore corporate earnings

- Where does this go from here?

Monday Sep 25, 2017

Federal Tax Update - Sept. 25, 2017

Monday Sep 25, 2017

Monday Sep 25, 2017

https://player.vimeo.com/video/235085305

This Week's Topics

- Hurricane Irma relief expanded to cover entire state of Georgia

- Volunteer attorney finds himself in a conflict of interest mess when husband has a change of heart

- Payment for issues in foreclosure found to create taxable income

- IRS opens pilot PLR program for D Reorg/Section 355 issues

- Proposed regulations issued for truncated SSNs on W-2--but not until 2018 W-2s